FAQs about Insurance Claims Asistance for Water Damage in Chatsworth CA

Why is insurance claims assistance important for water damage?

Insurance claims assistance is crucial when dealing with water damage because the claims process can be complex and daunting. Homeowners may not be familiar with the intricacies of their insurance policies or the requisite documentation needed for a successful claim. An experienced insurance claims assistant can help navigate the process, ensuring that all necessary paperwork is correctly filled out and submitted on time, which can significantly increase the chances of a favorable outcome. They can also help interpret policy language, negotiate with the insurance adjusters, and represent your interests to ensure that you receive the compensation you are entitled to for repairs and damages.

What does your insurance claims assistance service include?

Our insurance claims assistance service includes a comprehensive review of your insurance policy to determine coverage, direct communication with your insurance provider, detailed documentation of the water damage, and coordination with restoration professionals to provide estimates. Our team will advocate on your behalf to ensure that all relevant damages are accounted for in your claim. Additionally, we provide regular updates on the status of your claim and assist with any appeals if necessary. Our goal is to simplify the process for you and maximize your claim.

How long does the claims process take for water damage?

The length of the claims process for water damage can vary significantly depending on several factors, including the extent of the damage, the responsiveness of the insurance company, and the thoroughness of the documentation provided. On average, the process can take anywhere from a few weeks to several months. During this time, it's essential to have ongoing communication with your claims representative and restoration team to facilitate a smooth process. Our team can help expedite this process by ensuring that your claim is complete and accurately represents the damages.

Can I file a claim if the water damage is minor?

Yes, you can file an insurance claim for minor water damage, but whether it will be approved depends on policy specifics. Some policies cover small incidents, while others may have a deductible that could make minor claims unfeasible. It's best to consult with our claims experts, who can help evaluate the severity of the damage and determine if filing a claim is advisable based on your circumstances.

What steps should I take immediately after discovering water damage?

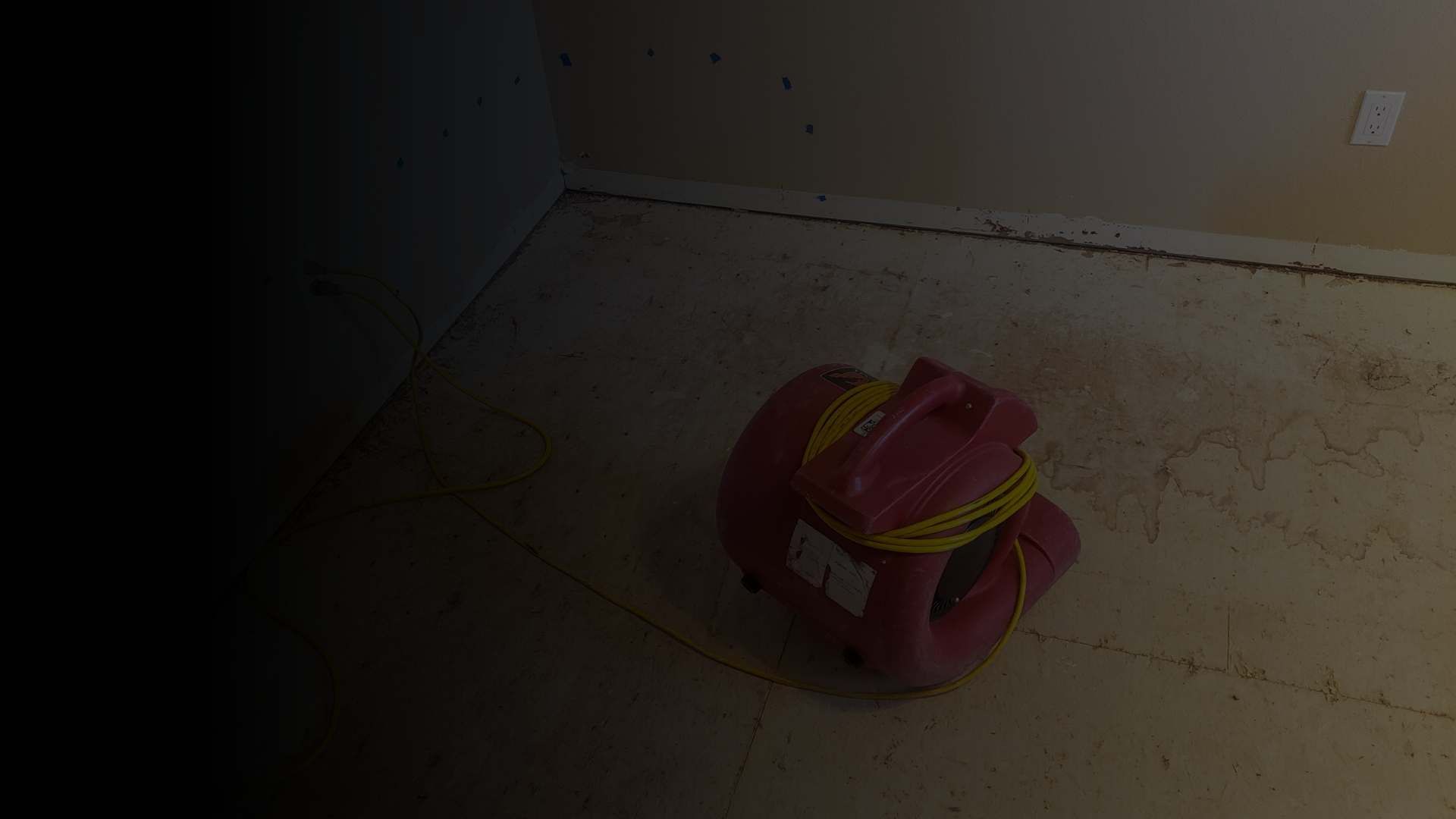

Immediately after discovering water damage, you should first prioritize safety—turn off any electrical sources and remove yourself from unsafe conditions. Next, document the damage with photos and start the claims process by contacting your insurance provider as soon as possible. If feasible, begin removing standing water and drying out the area to prevent further damage. Lastly, reach out to a professional water damage restoration company, like us, to assess the damage and help with your insurance claim.